Arbitrum in 2025: The Year of Everywhere

2025 marked a turning point for blockchain infrastructure.

This was the year institutional finance moved from exploration to execution. Tokenisation left the whiteboard and entered production. TradFi and onchain finance started to merge into a single operating model.

And at the centre of that shift was Arbitrum.

From powering the world’s largest retail trading platform to settling tokenised funds from some of the world’s largest asset managers, Arbitrum continued to show up as the venue of choice for major global institutions.

“2025 was the year that crypto captivated institutional finance and that megatrend will continue to accelerate across the landscape as capital allocators now act with conviction,” said Brendan Ma, Head of Investment Strategy at the Arbitrum Foundation.

“We have seen major milestones across the ecosystem, and Arbitrum is uniquely positioned to drive the momentum in 2026 by supporting institutional adoption, helping and growing talented teams, and reinvesting for long-term growth.”

That conviction is visible everywhere.

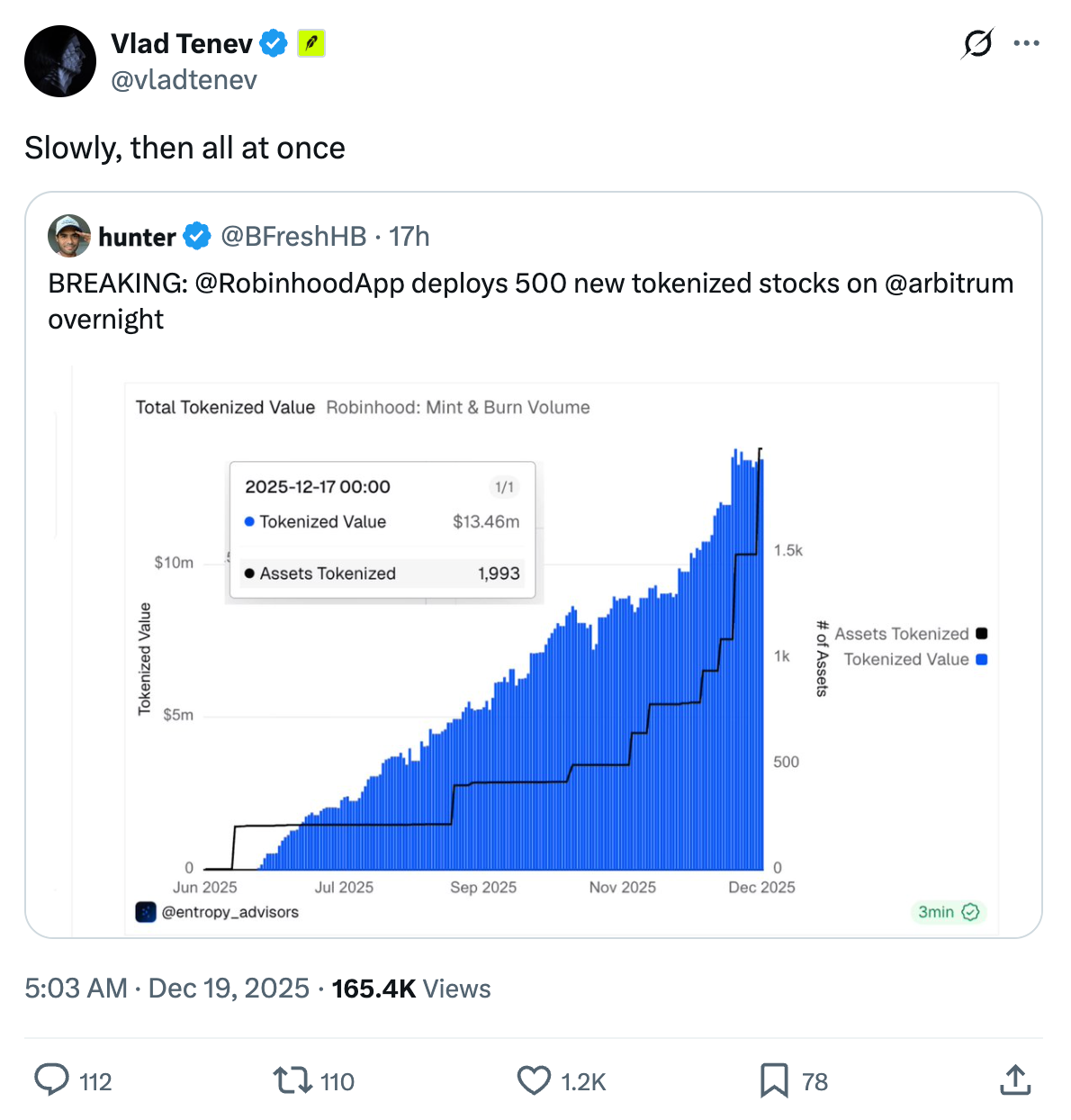

Robinhood’s launch of tokenised securities on Arbitrum showed what broader financial access can look like. Stablecoin supply climbed by 82%. Arbitrum also continued its lead in total value secured among L2s, supported by surging developer activity. ArbitrumDAO moved in lockstep with that scale: unlocking capital expansion through Franklin Templeton, WisdomTree, and Spiko deployments, and reinvesting returns for long-term ecosystem growth.

As 2025 closes, we reflect on some of the milestones that Arbitrum reached this year and the foundations laid for an exciting 2026.

Network Market Share

Arbitrum One crossed 2.1 billion+ lifetime transactions in 2025 after taking roughly three years for the first billion. The network added the second billion in less than 12 months. It continued to maintain its position as the leading L2 by market share, reaching a $20 billion+ Total Value Secured in 2025.

Ecosystem Expansion

The Arbitrum ecosystem grew rapidly in 2025, with 100+ chains live or in development, including some notable launches like the Ethereal Perps DEX, Zama, and Blackbird. 1,000+ projects are powered by Arbitrum as of today, making it a top 3 chain by number of protocols.

At the same time, the network generated over $600M in ecosystem GDP, a 30%+ YoY increase based on fees produced by applications on Arbitrum One.

Institutional Deployments

As RWAs went mainstream, Arbitrum became the venue of choice for major institutions bringing financial products into crypto, welcoming notable partners including Robinhood, Franklin Templeton, Blackrock, Spiko, and more. In June, Robinhood announced tokenized US stocks and ETFs for EU customers on Arbitrum. In just 6 months, this has ballooned to almost 2,000 tokenized equities on Arbitrum One. Robinhood will continue the momentum in 2026 with a dedicated blockchain built using the Arbitrum stack.

ArbitrumDAO’s STEP 2.0 initiative allocated 35M ARB toward RWA initiatives, including tokenized US Treasury products and supporting WisdomTree’s WTGXX, Spiko’s USTBL, and Franklin Templeton’s BENJI. In less than 12 months of launch, Spiko achieved $200M+ in AUM on Arbitrum.

DeFi & Financial Infrastructure

Arbitrum continued to grow as the liquidity anchor for DeFi. Stablecoins and RWAs saw a breakout in adoption on Arbitrum this year.

Stablecoin supply grew 82% YoY, roughly reaching $8 billion+ market cap. The network did not just grow as the deepest venue for onchain dollars amongst L2s but also as the most diverse across USDC, USDT, and newer assets like USDai, thBILL, and syrupUSDC. Ecosystem initiatives like DRIP helped fuel 229%+ growth in stablecoins on Arbitrum since its launch in September 2025.

Likewise, RWA tokenization on Arbitrum reached $1.1B+ in October, representing an 18X increase from the same period in 2024. This was coupled with scaled momentum across DeFi activities.

Arbitrum hosted the largest deployments of Aave and Uniswap outside Ethereum, with active loans rising 109% to $1.5B and new lending products from teams like Fluid expanding over 460%. DRIP program welcomed new teams like Morpho, Euler, and Maple Finance into the ecosystem.

Financial Strength

Arbitrum is uniquely positioned for high and sustainable margins as an L2, allowing the DAO to reinvest into a compounding flywheel for significant long-term growth. Arbitrum's ecosystem will end the year with 90%+ gross margins across four different revenue streams, up from just two last year. Timeboost, for example, launched in 2025 and generated $5M+ revenue in the first 7 months.

ArbitrumDAO is on track to end Q4 2025 with roughly $6.5M gross profit (~$26M annualized) and more than 50%+ period-on-period growth. The DAO has also strengthened its balance sheet, holding over $150M in non-native assets, including cash equivalents and ETH, positioning the ecosystem for sustained and strategic expansion.

Looking Ahead

2025 was a story of growth across major verticals and financial assets. From institutions to major asset classes, consumer applications to stablecoins, the ecosystem demonstrated its robustness to house global-scale financial activity.

As we head into 2026, the goal is simple. Together, we deepen the rails laid out to bring the benefits of open programmable finance everywhere they can create value. The work ahead is significant, but so is the momentum. The ecosystem is ready for its next chapter.

Arbitrum Everywhere.